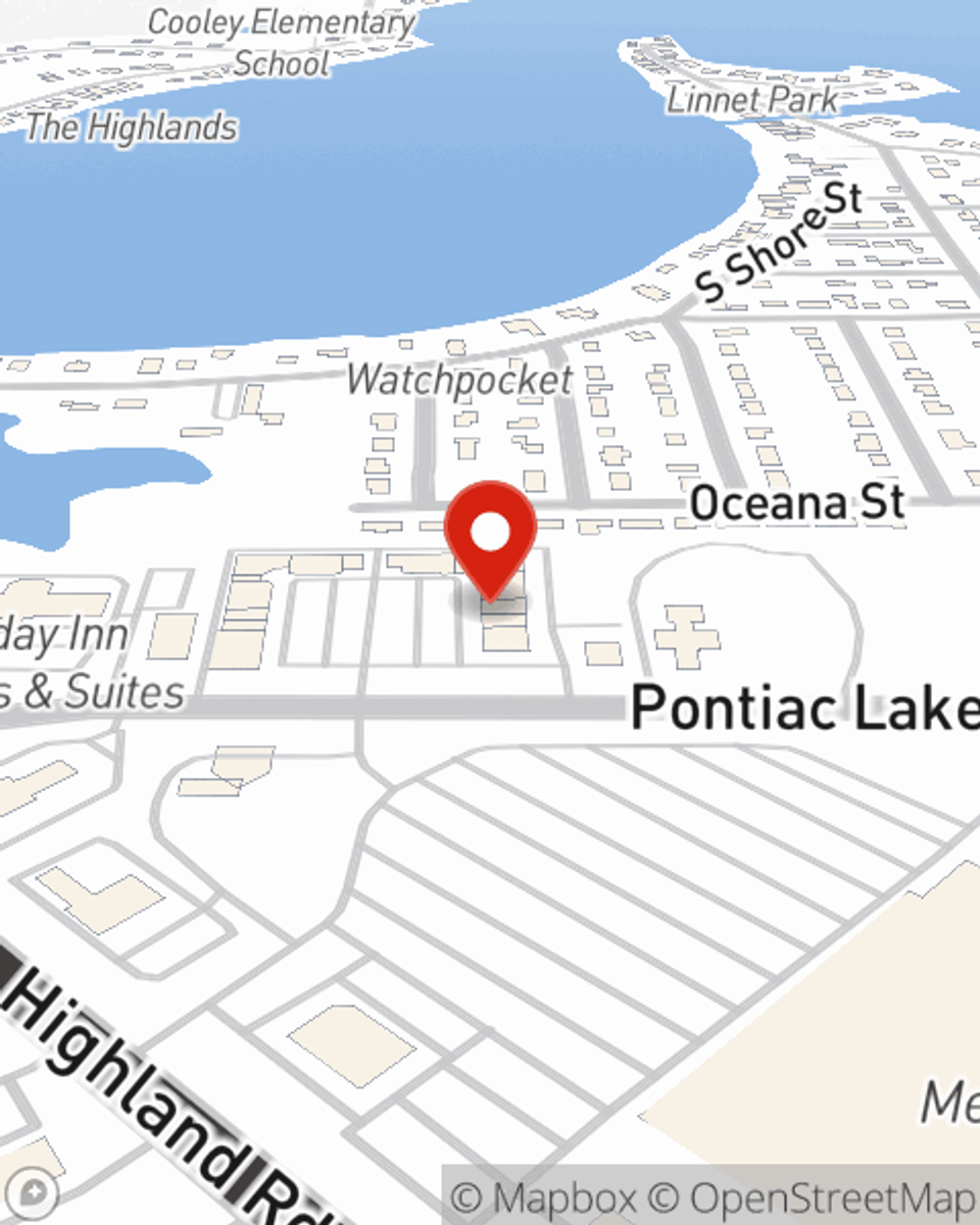

Business Insurance in and around Waterford

Searching for insurance for your business? Search no further than State Farm agent Sean Flynn!

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Mishaps happen, like a customer hurts themselves on your property.

Searching for insurance for your business? Search no further than State Farm agent Sean Flynn!

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

The unexpected is, well, unexpected, but that doesn't mean you shouldn't be prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or worker's compensation for your employees, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Sean Flynn can also help you file your claim.

Don’t let worries about your business keep you up at night! Call or email State Farm agent Sean Flynn today, and explore how you can benefit from State Farm small business insurance.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Sean Flynn

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.